Medical Malpractice insurance is essential for protecting your aesthetics practice. Whether you’re an experienced aesthetics professional or just starting out, having the right malpractice insurance can give you peace of mind and help protect you from the financial and legal implications if a treatment goes wrong.

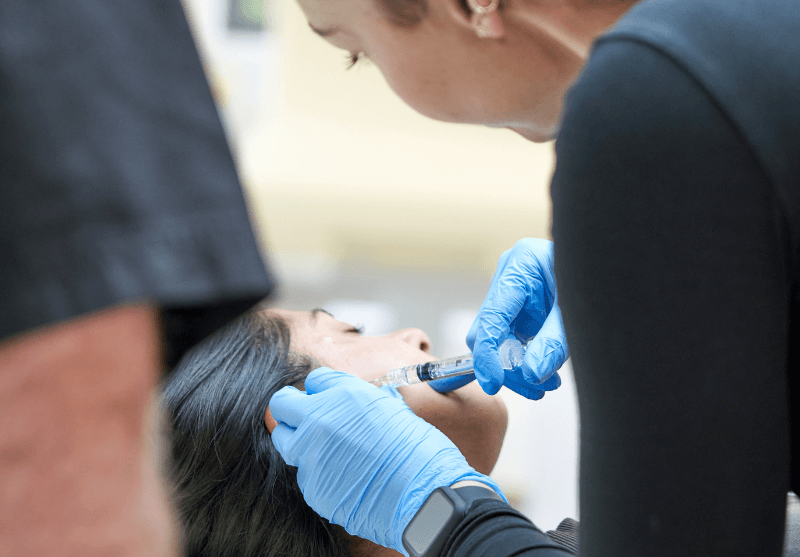

As an aesthetics professional, you’re likely to provide a range of cosmetic treatments to clients seeking to enhance their appearance. Whilst always maintaining the correct etiquette and striving to provide high-quality care, there’s always a chance that something could go wrong during, or after your practice – that’s where malpractice insurance comes in.

What Is Medical Malpractice Insurance?

Medical Malpractice insurance is a liability-led type of insurance that can help protect you in case of malpractice claims. For example, if a client is injured or experiences damages because of your treatment technique, your malpractice insurance can help cover the cost of any resulting medical bills, legal fees, and other expenses, which in some cases can prove to be an expensive disbursement.

This type of insurance can help provide a sense of security for both you and your clients and is an important and necessary investment for any aesthetics practitioner.

A comprehensive malpractice insurance policy can help provide peace of mind and protection for both you and your clients.

Explaining Claims Made and Occurrence Policies

There are two ways in which liability-led insurance policies are written, and understanding the differences between these is very important: claims-made and occurrence policies.

With a claims-made policy, you’ll be covered for claims that are made while the policy is in effect, providing the incident occurred after the ‘retroactive date’. This means that the policy must be active both when the alleged incident occurred and when the claim is filed with no gaps in cover and the retroactive date maintained.

An occurrence policy, on the other hand, covers you for any claims that arise from incidents that occurred during the policy period, regardless of when the claim is filed. Medical Malpractice policies are only available on a claims-made basis, and this is industry standard.

What is a “Retroactive Date” and Why Is It Important?

Another important term to understand as an aesthetics professional is “retroactive exposure” and “retroactive date”.

“Retroactive exposure” refers to coverage for incidents that occurred in the past but prior to the “retroactive date”, if those incidents were not previously known or reported.

A “retroactive date” is a specific date in the past that the cover will extend to. For example, if you were to originally purchase a malpractice insurance policy on 1st January 2020 the retroactive date will be set to this date on each subsequent renewal. It is crucial that when renewing coverage with a new insurer you inform them of the expiring retroactive date shown in your policy schedule. If this is omitted your new insurer will set the retro-date as the “Inception” of the new policy meaning you will have no cover for your past activities. If a client files a claim for a treatment that was provided on December 31, 2019, the retroactive date ensures that the policy will not cover the claim because the treatment was provided prior to the retroactive date.

The retroactive date is an important feature of an insurance policy because it affects when a policy will respond to a historic claim. In general, policies with earlier retroactive dates provide broader coverage.

It’s important to understand the retroactive date of a malpractice insurance policy before purchasing it to ensure that it provides the desired level of coverage for past events.

If you have been in business for some time before obtaining malpractice insurance, it’s vital that you speak to a trained insurance professional, regarding the potential to obtain some coverage for your past activities. However, it’s important that practitioners are aware that this additional cover is not always guaranteed/available and where it can be offered the insurer will charge an additional premium for this.

In summary, a retroactive date is an important feature of an insurance policy that marks the starting point of when a policy will respond to incidents that have occurred in the past.

Understanding the retroactive date is crucial for aesthetics practitioners who want to ensure that they have adequate coverage for their past exposure.

What is the Aggregate Limit of Indemnity in Malpractice Insurance for Aesthetics Professionals?

As explained, as an aesthetics professional you should now understand the importance of having malpractice insurance to protect you in case of unexpected events. Another important aspect of malpractice insurance that you should understand is the aggregate limit of indemnity.

For example, imagine that you as an aesthetics professional have a malpractice insurance policy with an aggregate limit of £1,000,000. During the policy period, you may have three clients whom each file a malpractice claim against you. The first claim is settled for £300,000, the second for £500,000, and the third for £200,000. In this case, the total amount paid out by the insurance company would be £1,000,000, which is the policy’s aggregate limit. Once the indemnity limit has been exhausted a new policy would need to be purchased to protect against any further claim.

Aesthetic professionals need to choose an insurance policy with an aggregate limit of indemnity that is high enough to adequately protect you in case of multiple claims. The amount of coverage needed may vary depending on the type of services provided, the number of clients, and other factors that need to be considered.

When it comes to this, it may be a good idea to consult with an insurance professional to determine the appropriate level of coverage for your individual needs.

What Does Run-Off in Insurance Mean?

Run-off is a term used within the insurance industry to describe a period following retirement or a business ceasing to trade where the insured wishes to have cover in force to protect against any claims that may be made against their past activities. Most insurers will only provide run-off cover to aesthetics professionals that held a live policy prior to the cessation of activities.

For example, suppose you’re an aesthetics professional that has chosen to close your business and you have decided not to place your malpractice insurance policy into run-off. If a patient then files a claim for a treatment that was provided during the policy period but after the policy had expired and run- off has not been taken, the insurer will not respond to this notification.

Most policies require the run-off cover to be renewed on an annual basis, the cost of the first year will generally be charged at the same rate as the expiring live policy and if no claims are made during the year, insurers can offer a slight reduction on subsequent renewals until you reach their minimum premium or decide not to renew cover. It’s important to understand the terms of policy and the applicable laws to determine how long the run-off period lasts.

Run-off coverage is important because it ensures that aesthetics professionals are protected from claims that arise after they have stopped offering treatments. This is particularly important for aesthetics practitioners, who may face claims that arise months or even years after a treatment has been provided.

Without run-off coverage, professionals would be personally responsible for covering any claims that arose after their policy expired.

In Summary

As an aesthetics professional, malpractice insurance is especially important because you’re working with clients who are often seeking cosmetic treatments that involve risks. Even the most experienced aesthetics professionals can make mistakes or encounter unexpected complications, and having malpractice insurance can provide ease of mind for both you and your clients.

If you’re an aesthetics professional, it’s important to speak with an insurance professional, such as our Brokers at Fox Insure, to determine the best type of malpractice insurance policy for your needs. With the right coverage in place, you can feel confident that you’re protected in case of unexpected events, and you can provide your clients with the high-quality care they expect and deserve. Finding the right cover doesn’t have to give you wrinkles.

For any other questions, don’t hesitate to contact us for more information on your query.